Overlay a US map of microgrids against a map of solar installations, and you’ll see a lot of solar and not as many microgrids.

The US has 235.7 GW of solar in 2024, but only an estimated 7-10 GW of microgrids.

New York-based SolMicroGrid, a portfolio company of Morgan Stanley Energy Partners, sees an opportunity in this mismatch.

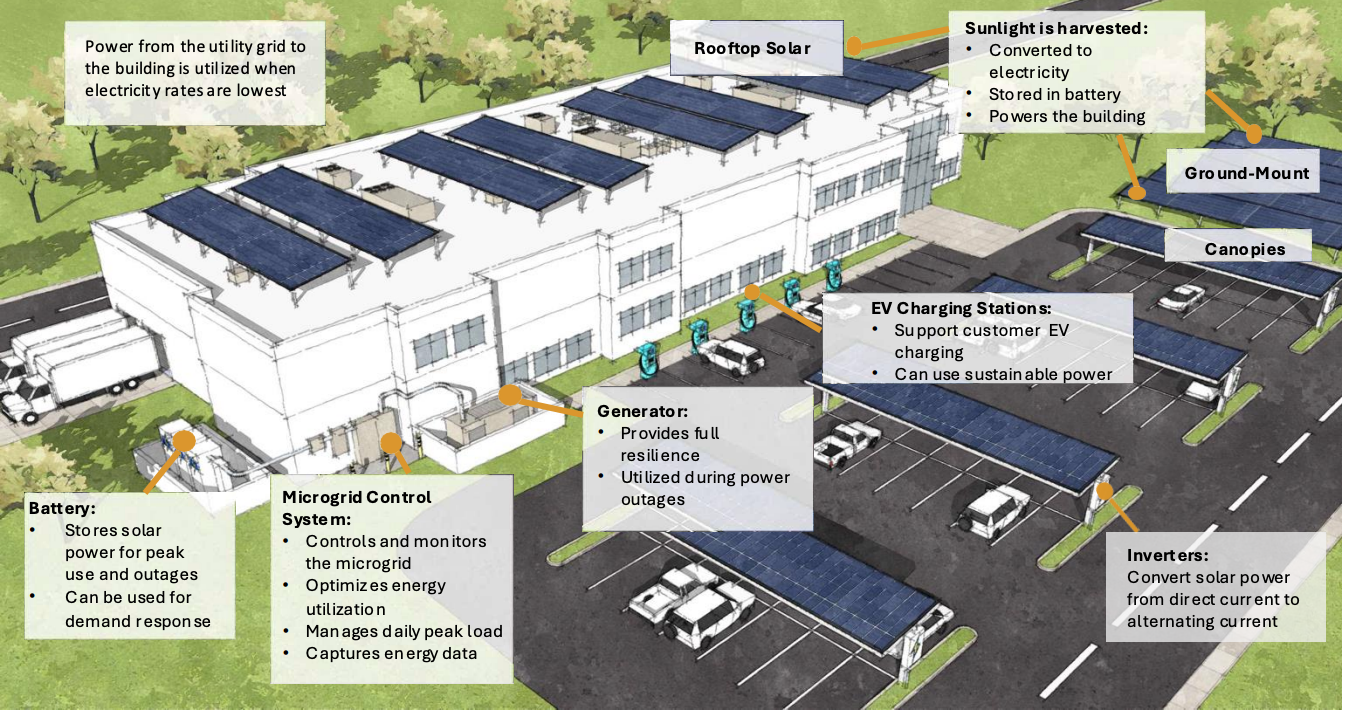

The company has launched a new program, Array-to-Microgrid, that converts existing solar installations into full-fledged microgrids for commercial and industrial (C&I) enterprises.

“I thought that might be a terrific way for us to get into new markets, find new customers, and grow our portfolio quicker,” said Kirk Edelman, CEO of SolMicrogrid, known for its Chick-fil-A microgrids. “A lot of people bought C&I solar arrays and put them on their property a number of years ago. It’s no longer the shiny toy on Christmas morning.”

By adding controllers, batteries, generators or fuel cells to the system, SolMicrogrid provides the host with backup power during a grid outage that is not available with stand-alone solar installations.

Financial advantages of going from solar to microgrid

But the company is largely positioning Array-to-Microgrid for its financial advantages. The program operates under an energy-as-a-service model, selling power to the customer at a discount to utility rates.

SolMicrogrid buys the existing solar array, providing an upfront infusion of cash for the customer. It then adds the components to create a microgrid and takes over the operation and maintenance of the system. The microgrid produces energy below utility rates, and SolMicrogrid and the customer share the savings.

Learn more about microgrids. Subscribe to the free Energy Changemakers Newsletter.

“I’ve got to create as much value as possible because I’m taking X percent, and you’re getting Y percent. So how do I make that spread the greatest?” he said.

To achieve the best spread, the company seeks locations where electricity places are high and chooses equipment in a technology-agnostic fashion.

“We’re only going to introduce a battery into the project if it creates more value that we split with our customer or our host. And so we look at it very carefully. Some places the tariff just doesn’t really support a battery; in other places it does,” Edelman said.

Location and size specific

He said that going from solar to microgrid works best economically in California, the Northeast, and the Mid-Atlantic, where utility rates tend to be high.

“We can’t do this for everybody everywhere because we do create value, which we split,” he said. “The bottom line is technology driven on our side, the top line is a function of where the company is, who’s going to be a potential host for us, what their utility rates are, what their utility tariff looks like. If you don’t have time-of-use benefits, if you don’t have a lot of peaks in your demand curve, that takes away a lot of the value creation from the battery.”

Many project development companies chase big energy consumers, but SoMicroGrid is going another route, focusing on the less sought-after small C&I market, particularly retailers, hotels, restaurants, supermarkets, auto dealerships and other businesses. They become more attractive to SolMicrogrid if they have multiple sites, like Chick-fil-A.

“Would we do really large projects? Of course we would. But on the smaller side that we operate in, it’s not over shopped by C&I solar developers,” Edelman said. “A lot of people believe that you can’t do a smaller project, the transaction costs will eat away at your profits, and there’s some truth to that. So the key to our business model is we’ve got to be very efficient at everything we do. We have to constantly be making forward progress.”